New Delhi: The ongoing debate over the taxation of caramelized popcorn has ignited a storm among food vendors, cinema owners, and consumers, leading to growing concerns about the classification of sweetened snacks under India’s Goods and Services Tax (GST) regime. The issue recently drew attention after Finance Minister Nirmala Sitharaman was asked about the matter during a press conference.

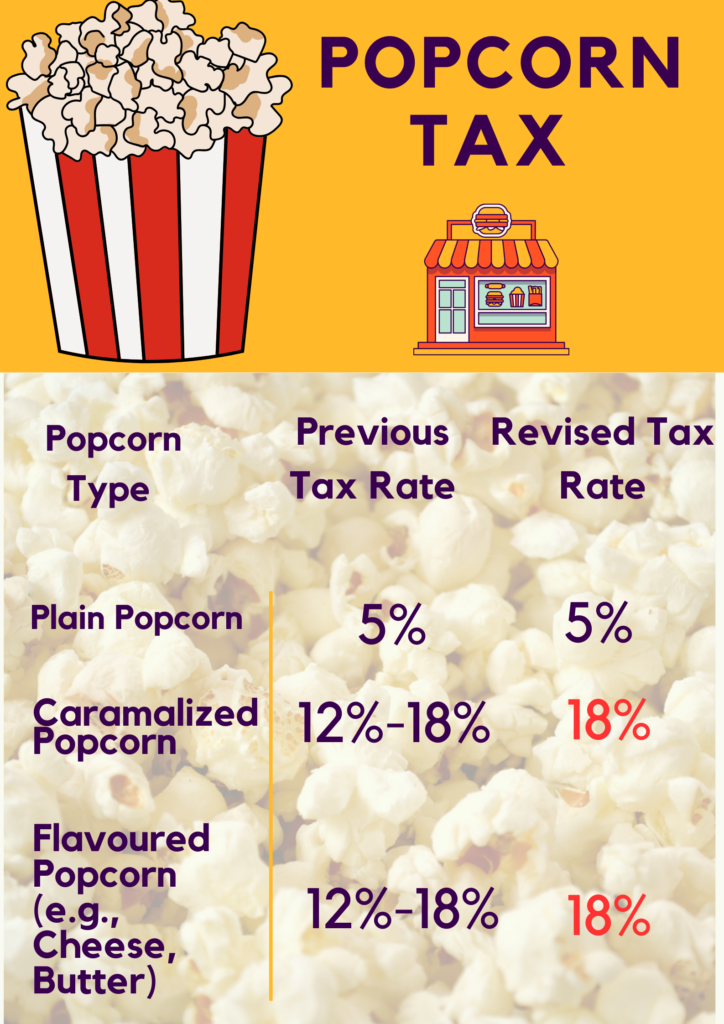

Currently, under the GST framework, snacks such as plain popcorn are considered a food item and taxed at a lower rate. However, caramelized popcorn, which is often sweetened and flavored, is classified differently and taxed at a higher rate, which some vendors argue is unfair and detrimental to their businesses.

“Popcorn is a popular snack in India, and for many, it’s part of the cinema and street food culture. The differentiation in tax rates based on flavoring, like caramelization, is causing confusion among small businesses and consumers alike,” said Sitharaman in her address.

The issue gained traction after small-scale popcorn vendors and cinema chains highlighted the disparity in taxation between plain popcorn, which is taxed at 5%, and caramelized popcorn, which could attract GST rates as high as 18%. Critics of the current tax structure argue that the added sugar and flavorings should not push the snack into a higher tax bracket, as it remains a simple food item.

Several petitions have been filed by industry associations, calling for a reconsideration of the tax classification. “The tax on caramelized popcorn is unfair. It makes a widely loved snack more expensive for families, especially in cinemas and theaters. The current tax regime is creating an unnecessary burden on both vendors and consumers,” said a spokesperson from the All India Cinema Owners Association.

GST – गब्बर सिंह टैक्स का एक और वार

🍿पॉपकॉर्न पर अब 18₹% GST देना होगा

🚙 पुरानी कार बेचने पर 18% GST लगेगा

अब संसद के अगले सत्र में सुनाई देगा

👉 मैं पॉपकॉर्न वॉपकॉर्न नहीं खाती

👉 मैं तो चमचमाती सरकारी गाड़ी से चलती हूँ, मुझे पुरानी गाड़ी से क्या

🤷🏻♀️🤷🏻♀️

वैसे… pic.twitter.com/UPHV7RQxpY

— Supriya Shrinate (@SupriyaShrinate) December 21, 2024

The Finance Minister, however, defended the tax structure, stating that the classification is in line with broader food industry standards, which separate basic foodstuffs from processed and flavored items. “Taxation of food items, including snacks like caramelized popcorn, is based on their nature and the value added through processing,” Sitharaman explained.

Read Also: Priyanka Gandhi’s ‘Palestine’ Bag Sparks Row, Doubles Down with ‘Bangladesh’ Message in Parliament

Experts believe that this tax dispute could set a precedent for future discussions on food taxation in India. The government is expected to review the matter and engage in consultations with stakeholders to determine if any amendments are necessary. For now, businesses and consumers alike will have to navigate the complex landscape of food taxation under the GST regime.

As the issue unfolds, many hope that a resolution will be reached that balances both the economic interests of small vendors and the government’s revenue objectives.

Follow us on Facebook, X, YouTube & Instagram to never miss an update from The Credible India